Student loan forgiveness

The possible new date appears in a court document for a lawsuit. For example if your federal tax rate is 30 and you receive forgiveness on 30000 of federal.

Details On The Biden Administration S 10 000 Federal Student Loan Forgiveness Aaf

Yes you will owe income taxes on the amount forgiven.

. Student loan forgiveness is granted to people with Total and Permanent Disability or TPD. Loan forgiveness is available for loan amounts up to 17500. If you work there for at least three years youll receive up to 60000 in loan forgiveness.

A US district judge could decide soon whether to temporarily block President Joe Bidens student loan forgiveness program from taking effect after hearing a motion for a. To be eligible for 10000 in loan. Up to 10000 if they didnt receive a Pell Grant.

This program can be used on Direct Subsidized and Unsubsidized Loans as well as Subsidized and Unsubsidized. The Biden administration crafted its student debt forgiveness proposal in an attempt to avoid benefiting the wealthiest families. August 26 2021 Extended Closed School Discharge Will Provide 115K Borrowers from ITT Technical Institute More Than 11B in Loan Forgiveness Today the US.

Student loan interest payments are reported on the IRS Form 1098-E Student Loan Interest Statement. President Joe Biden announced on Aug. For example Congress could phase out eligibility to cancel student loans based on a student loan.

Login to My Federal Student Aid Federal student. Congress could limit student loan forgiveness based on income. Up to 10000 if they didnt receive a Pell Grant.

23 is looking to be the soonest date the Department of Education can begin canceling student loan debt. I am very grateful for this watershed. Student Loans Forgiveness.

President Joe Biden announced in August that most federal student loan borrowers will be eligible for some forgiveness. Student Loans Forgiveness. Borrowers can qualify for debt forgiveness based on their income in either the 2020 or 2021 tax year.

You must have at least 10000 in federal loans to qualify though thats a pretty. Contact Your Loan Servicer QuestionsMake a paymentLoan balance. If you made federal student.

The Biden administration on Thursday is kicking off its efforts toward forgiving student loan debt sending updates on the process via email before the window to apply opens. Since President Biden announced his student loan forgiveness plan the reaction has been predictable and political. So if you earned 120000 in 2020 but got a big raise in 2021 you still.

TPD means you are unable to work due to a serious illness or long-term injury. Before you need to even worry about applying for student loan forgiveness under the Biden administrations new plan youll need to make sure you actually qualify. 24 that most federal student loan borrowers will be eligible for some forgiveness.

Who Are The Federal Student Loan Borrowers And Who Benefits From Forgiveness Liberty Street Economics

Everyone Has Opinions About Student Loan Forgiveness Bloomberg

President Biden Announces Student Loan Forgiveness Abc News

Federal Student Loan Forgiveness And Discharge Great Lakes

Student Loan Refund Who Will Pay For Student Loan Forgiveness Marca

Student Loan Forgiveness Program Burlington Ma

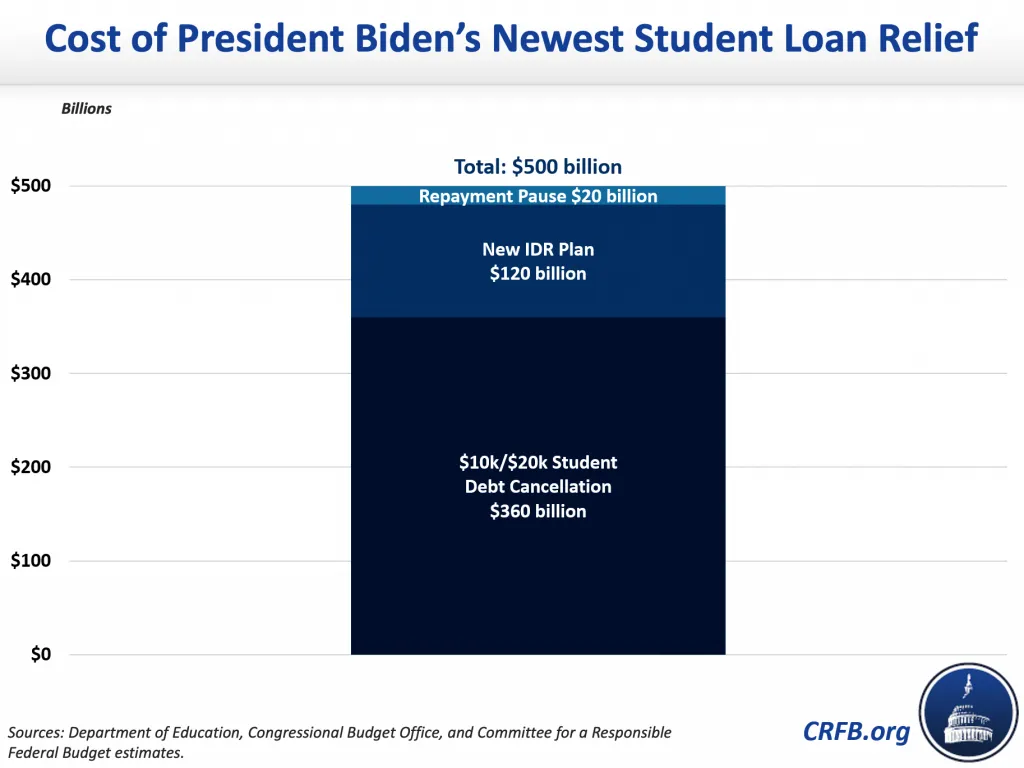

New Student Debt Changes Will Cost Half A Trillion Dollars Committee For A Responsible Federal Budget

The Student Loan Forgiveness Application Is Official 8 Things To Know The Washington Post

The Student Loan Forgiveness Application Is Live But Will You Owe Taxes On Debt Relief Cnet

Joe Biden Could Have Gone A Lot Further On Student Loans Mr Online

Biden Leans Toward 10 000 In Student Loan Relief Advocates Push Back

Student Loan Forgiveness Will Benefit Some But Leaves Others Hesitant

Student Loan Forgiveness Is A Savvy Political Move And The Right Thing To Do The Boston Globe

Here S What Our Readers Think About Biden S Student Loan Forgiveness Program Knbn Newscenter1

What We Know About Biden S Student Loan Debt Forgiveness Plan Pbs Newshour

Putting Student Loan Forgiveness In Perspective How Costly Is It And Who Benefits

Millennial Voters Are Most Likely To Back Total Federal Student Loan Forgiveness